what is suta tax rate for 2021

Please note the rates are subject to change. You should be aware of current rates and understand how the tax is calculated.

Employment Tax Returns Forms Due Dates More

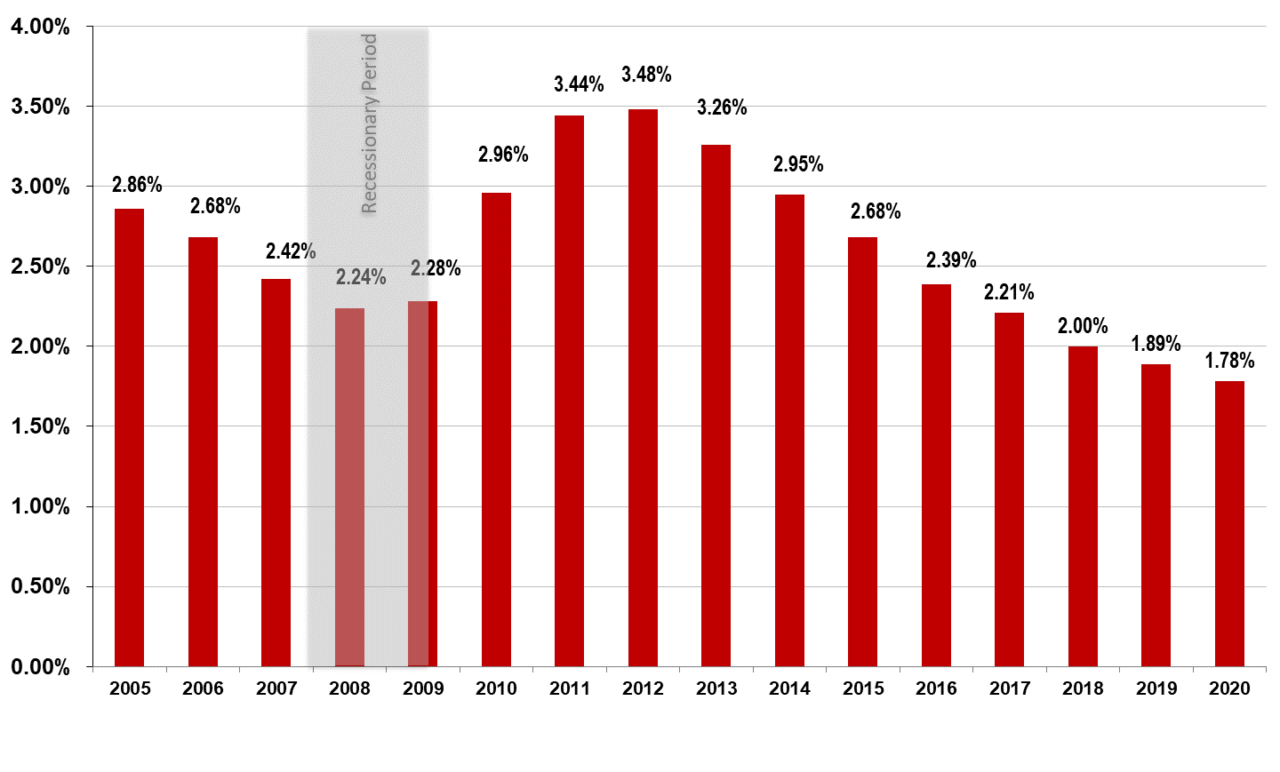

Percent of Taxable Wages.

. What are payroll taxes. DE 8829 Household Employers Guide. Use the table below to calculate the interest due on delinquent unemployment insurance taxes.

Section 96-92e Final Date for Protest. Exhaustion Rate in Regular Program 12 months ending 04302022. If you are self-employed you must pay the entirety of the 153 FICA tax plus the additional Medicare tax if applicable and well get to that in a minute.

The credit maximum is 54. For this edition the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. The chart below outlines 2022 SUTA employer tax rate ranges.

Determine the interest rate applicable to the delinquent periods. The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and 090 for 2025. As we go to press the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication.

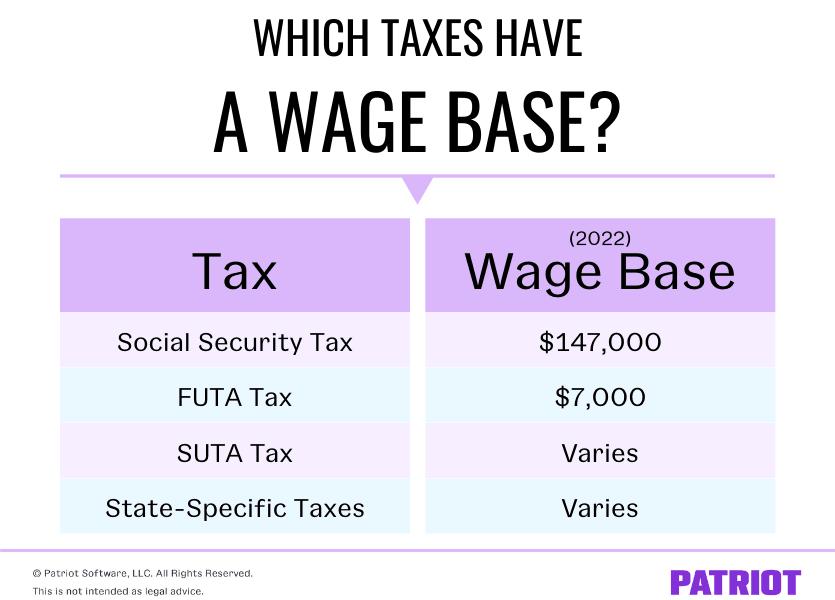

Use this rate to calculate line 4 on the Quarterly Combined Withholding. Employers that are eligible for a tax rate calculation have the option to submit a voluntary payment to reduce their UI tax rate for the purpose of lowering their UI tax due for the year. In 2021 this wage base is 142800.

It shows how much the employee is paid on an hourly or salary basis. Section 96-92c Maximum UI Tax Rate. Tax Performance System TPS Computed Measures Program Integrity Measures.

California System of Experience Rating DE 231Z PDF. The FUTA tax rate is 60. Wage Reporting and Unemployment Insurance Report NYS 45.

April 25 July 25 Oct. SUTA Dumping a penalty rate of 2 of taxable wages shall be added to both employers rates for three years. Number Of Hours Worked.

SUTA tax may also be called. See how FICA tax works in 2022. SUTA tax works similarly to FUTA tax but its for state unemployment.

The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper. SUTA tax FICA tax 401k etc. The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require.

Multiply the amount of tax due by the interest rate for each month or portion thereof from the due date to the date paid. The temporary rate was extended many times but it expired on June 30 2011. State Unemployment Tax Act SUTA dumping refers to attempts by employers to pay lower state unemployment taxes than their experience rate allows.

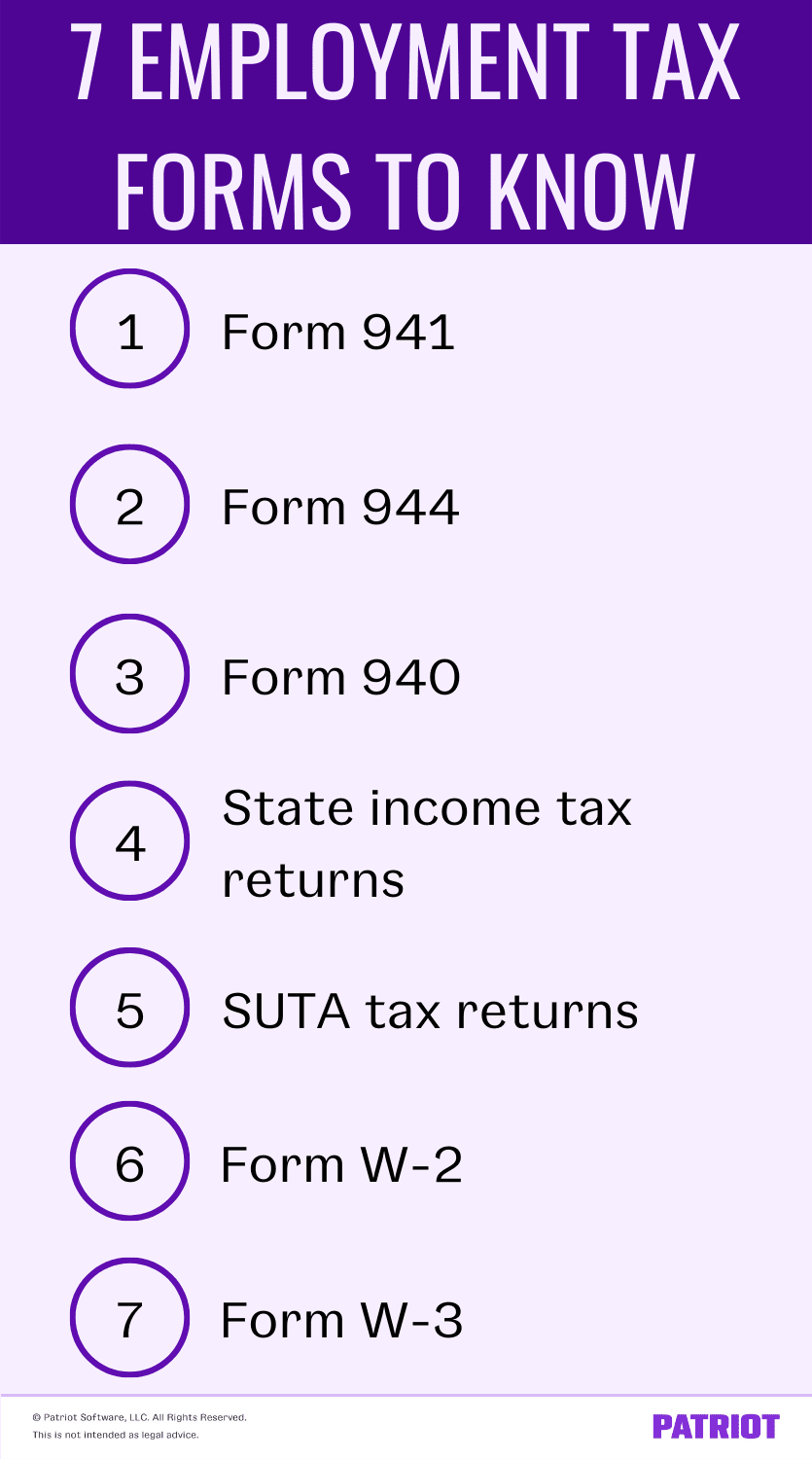

State unemployment on time and arent in a credit reduction state may be eligible for a lower federal unemployment tax rate. Employers remit withholding tax on an employees behalf. Use Form W-3 Transmittal of Wage and Tax Statements to transmit Forms W-2 to the Social.

The tax rate is based on withholdings chosen on the employees W-4 form. Medicare tax withholding of 145 State income tax withholding. Less than 0 The Unemployment Insurance contribution rate is the normal rate PLUS the subsidiary rate.

For example in Michigan the taxes are due on the 25th of the month instead of the end of the month. Social Security taxes have a wage base. For more information about how your UI rate is determined refer to Information Sheet.

December 15 2021 Final Date for Voluntary Contribution. Social Security tax withholding of 62 in 2020 and 2021 up to the annual maximum taxable earnings or wage base of 137700 for 2020 and 142800 for 2021. The Voluntary UI program is not in effect for 2021.

A credit when you file your Form 940. State taxes vary including the State Unemployment Tax Act SUTA contribution rates. Employers must deposit and report employment taxesSee the Employment Tax Due Dates page for specific forms and due dates.

The interest rate is established under 105-24121. Section 96-92b Minimum UI Tax Rate. If you are entitled to such a credit your final FUTA tax rate would be the standard FUTA tax rate of 60 minus the credit.

Contribution from the employers side may vary depending on the benefit opportunities provided. Keep in mind that not all employers qualify for the FUTA tax credit. Visit your states official government website for complete and.

There are a few names that SUTA tax goes by depending on the state. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. To learn more about federal Social Security Medicare.

DE 44 California Employers Guide. State law instructs ESD to adjust the flat social tax rate based on the employers rate class. Until June 30 2011 the Federal Unemployment Tax Act imposed a tax of 62 which was composed of a permanent rate of 60 and a temporary rate of 02 which was passed by Congress in 1976.

Part of the collaboration between the federal and state programs allows any state that is fully compliant with FUTA requirements to receive a credit for their employers of up to 54. The total of the experience tax and the social tax cant exceed 6. DE 3DI-I Disability Insurance Elective Coverage DIEC Rate Notice and Instructions for Computing Annual Premiums.

Recent legislation changed Floridas reemployment tax rate computation for rates effective 2021 through 2025 The new. Section 96-92c Mail Date for Unemployment Tax Rate Assignments For 2022. This means that most employers have an effective tax rate of 06 or a maximum expense of 42 per year per worker.

Various local tax withholdings such as city county or school district taxes. In addition an intentional violation of this. This is the maximum amount of wages per employee per year that you owe SUTA tax on we previously.

FUTA Employer-Paid Maximum Taxable Earnings. Employer payroll tax rates are 62 for Social Security and 145 for Medicare. Your UI ETT and SDI tax rates are combined on a single rate notice Notice of Contribution Rates and Statement of UI Reserve Account DE 2088.

UI Tax Rate for Beginning Employers. For 2022 the new employer normal contribution rate is 34. In all other years the flat social tax is capped at 122.

Employee Employer Tax RateUnchanged from 2021 620. At the end of the year you must prepare and file Form W-2 Wage and Tax Statement to report wages tips and other compensation paid to an employee. The Pay rate also known as wage rate is that employees rate of pay for their particular job.

Reemployment Tax Rate Computation Effective 2021 through 2025. However SUTA tax due dates vary by state. Effective July 1 2011 the rate decreased to 60.

What Is A Wage Base Definition Taxes With Wage Bases More

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Suta Tax An Employer S Guide To The State Unemployment Tax Act

Suta Vs Futa What You Need To Know

![]()

State Unemployment Tax Ballotpedia

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

State Unemployment Tax Increases In 2021 What Businesses Need To Know Proservice Hawaii

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Oed Unemployment Ui Payroll Taxes

940 Futa Suta Tax Rates For 2021 Form 940 Futa Credit Reduction States

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

Futa Tax Overview How It Works How To Calculate

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

What Is Sui State Unemployment Insurance Tax Ask Gusto

Are Employers Responsible For Paying Unemployment Taxes